Compounding Swap

FinPricing offers:

Four user interfaces:

- Data API.

- Excel Add-ins.

- Model Analytic API.

- GUI APP.

FinPricing provides valuation models for the following swaps:

An interest rate swap is an agreement between two parties to exchange future interest rate

payments over a set of future times. There are two legs associated with each party.

Interest Rate Swaps are

the most popular OTC derivatives that are generally used to manage exposure to fluctuations in interest rates.

| 1. Compounding Swap Introduction |

A compounding swap is an interest rate swap in which interest, instead of being paid,

compounds forward until the next payment date. Compounding swaps can be valued by assuming that the forward rates are

realized. Normally the calculation period of a compounding swap is smaller than the payment period. For example, an

interest rate swap has 6-month payment period and 1-month calculation period (or 1-month index tenor).

An overnight index swap (OIS) is a typical compounding swap.This presentation gives an overview of compounding swap

product and valuation model.

| 2. Compounding Swap Valuation |

You may find different swap valuation models online: some just for intuitive understanding,

some obsolete and others not even correct. In this page, we elaborate the real-world model used in the market for

calculating fair value and risk.

A compounding swap consists of two legs: a regular fixed leg and a compounding leg. The compounding leg is similar to a ency and 3 month payment frequency. The most popular compounding swap is Overnight Indexed Swap (OIS).

The present value of a compounding leg is given by

Here we assume that there are k reset periods within the i-th cash flow.

The present value of the fixed leg is the same as (1)

The final present value of the swap is

Practical Notes

| 3. Related Topics |

| 3.1 Interest Rate Basis Swap |

A basis swap is a swap where two parties exchange periodic floating rate payments. Both legs of a basis swap are floating but derived from different index rates (e.g. LIBOR 1 month vs 3 month).

The present value of leg 1 is given by

The present value of leg 2 can be expressed as

where the notations are the same as leg 1.

The final present value of the swap is

Practical notes

You can find more details at Interest Rate Basis Swap

| 3.2 Interest Rate Amortizing Swap or Accreting Swap |

An amortizing swap is an interest rate swap whose notional principal amount declines during the life of the contract whereas an accreting swap is an interest rate swap whose notional principal amount increases instead. The notional amount changes could be one leg or two legs. To be generic, we assume that the notional amount changes apply to both legs. The analytics are similar to a vanilla swap except the national amount used per period may be different.

The present value of a fixed leg is given by

The present value of a floating leg can be expressed as

The final present value of the swap is

Practical notes

You can find more details at Interest Rate Amortizing and Accreting Swap

| 3.3 Interest Rate Vanilla Swap |

A vanilla interest rate swap consists of a floating leg and a fixed leg. Here we simplify some notations in the model specification for brevity. More details are provided in practical notes for people who are interested in.

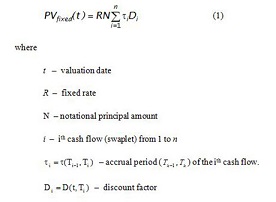

The present value of a fixed leg is given by

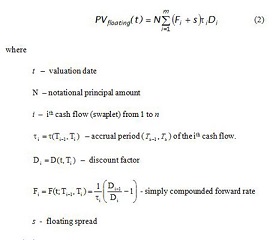

The present value of a floating leg can be expressed as

The final present value of the swap is

Swap Rate and Swap Spread

A swap rate is the fixed rate that makes a given interest rate swap worth zero at inception.It can be easily derived from (1) and (2) as follows.

Swap spread is defined as the difference between a swap rate and the rate of an on-the-run treasury with the same maturity as the interest rate swap. The swap spread is the additional amount an investor would earn on an interest rate swap as compared to a risk-free fixed-rate investment.

Final practical notes

| References |