Spread Option

FinPricing offers:

Four user interfaces:

- Data API.

- Excel Add-ins.

- Model Analytic API.

- GUI APP.

FinPricing provides valuation models for:

| 1. Spread Option |

A spread option is a financial intrument that offers a payoff dependent on the spread of two underlying assets. To price a spread option, one needs to compute the expected spread in a forward risk neutral world with respect to the maturity.

If the spread is always positive, it is sometime reasonable to assume that it follows lognormal distribution. If the spread can be positive or negative, one can assume that it is normally distributed. Another approach is to assume that each of the two assets are lognormal and that there is a correlation between them.

Spread options can be used for hedging and risk management. They allow investors to simultaneously take positions on two assets and profit from their price difference and movement

| 2. Spread Option Payoff and Valuation |

Unlike a standard European option, no closed form solution is available if both underlying assets are lognormally distributed. In this case, a numerical method can be used to valu e the expectd payoff in a risk-neutral world. Also under an additional assumption that the spread of two assets is normally distributed, a closed form can be derived.

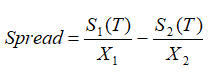

A spread option price can be computed based on the calculated forward prices of the underlying assets. The spread can be calculated via one of two formulas: the difference of returns between two assets,

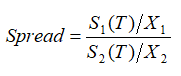

or the ratio of returns of two assets:

where X1 denotes the Initial Level of Asset i.

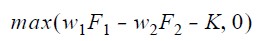

The payoff of an European call spread option is given by:

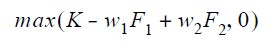

The payoff of an European put spread option is given by:

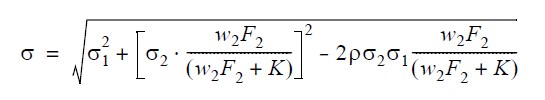

The valuation of a spread option needs two volatility values that may come from two different volatility surfaces. The joint volatility can be approximated by:

| 3. Related Topics |